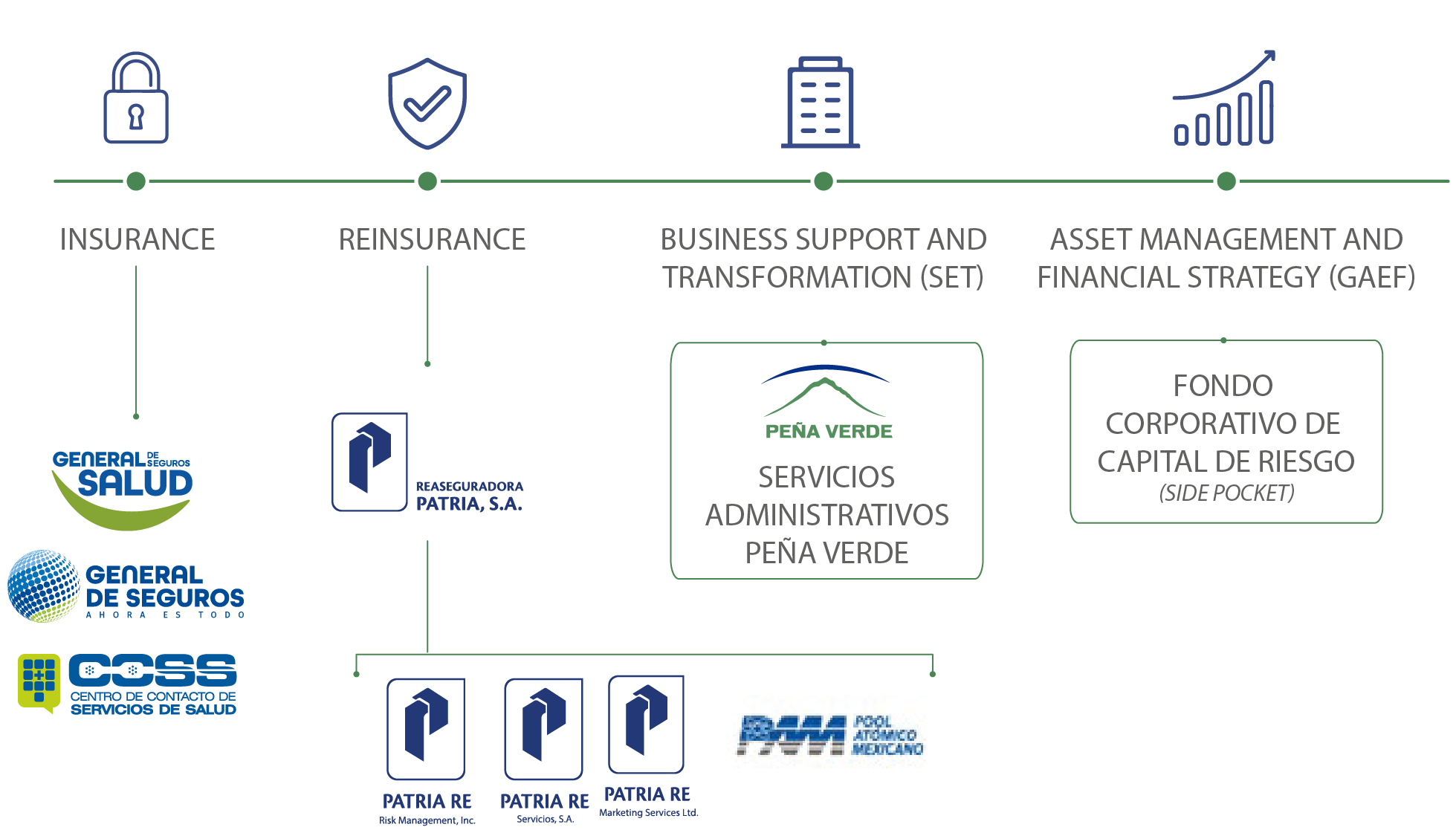

Grupo Peña Verde has the four business divisions shown below:

Both the Insurance and Reinsurance Divisions focus on risk management. The Insurance Division includes General de Seguros, which in turn integrates General de Salud and other subsidiaries into its operations, while the Reinsurance Division includes Reaseguradora Patria and its subsidiaries, which operate in Mexico and internationally.

The Business Support and Transformation Division (SET) is responsible for implementing technological and cultural transformation initiatives aimed at making the Group’s operations more efficient in terms of time and cost. The purpose of the Asset Management and Financial Strategy Division (GAEF) is to consolidate optimal capital management in a single area.

Both the SET and GAEF Divisions are part of Servicios Administrativos Peña Verde, a subsidiary that seeks to consolidate in Grupo Peña Verde a participative and innovative organizational culture that strengthens the competitiveness of all business areas.

In summary, the Group generates value on two fronts; on the one hand, our operations provide resources that can be invested and an operating margin; and on the other hand, our investment portfolios help to increase profit margins and diversify the risk we are taking.

INSURANCE

<<<<<<< HEAD

General de Seguros

Mexican company recognized for its wide variety of products that provide its clients with life, auto, damage, and agricultural protection (being one of the few companies that offer this type of insurance), as well as coverage for health and medical expenses, through General de Salud. In addition, it is authorized to operate both credit insurance and reinsurance.

In the insurance market, General de Seguros has a solid track record of 50 years as of the beginning of 2022, in which it has capitalized on its timely and efficient service to rank, at the end of 2021, in the #30 position in the Mexican insurance market, based on the amount of direct premiums written.

General de Seguros

Mexican company recognized for its wide variety of products that provide its clients with life, auto, damage, and agricultural protection (being one of the few companies that offer this type of insurance), as well as coverage for health and medical expenses, through General de Salud. In addition, it is authorized to operate both credit insurance and reinsurance.

In the insurance market, General de Seguros has a solid track record of 50 years as of the beginning of 2022, in which it has capitalized on its timely and efficient service to rank, at the end of 2021, in the #30 position in the Mexican insurance market, based on the amount of direct premiums written.

General de Salud

100% Mexican company and subsidiary of General Seguros, which has more than 15 years of experience offering health insurance, with the purpose of meeting both individual and SME’s needs through group plans, providing from primary coverage (prevention and medical consultations) to integral coverage (ancillary services, maternity, dental, hospitalization, among others).

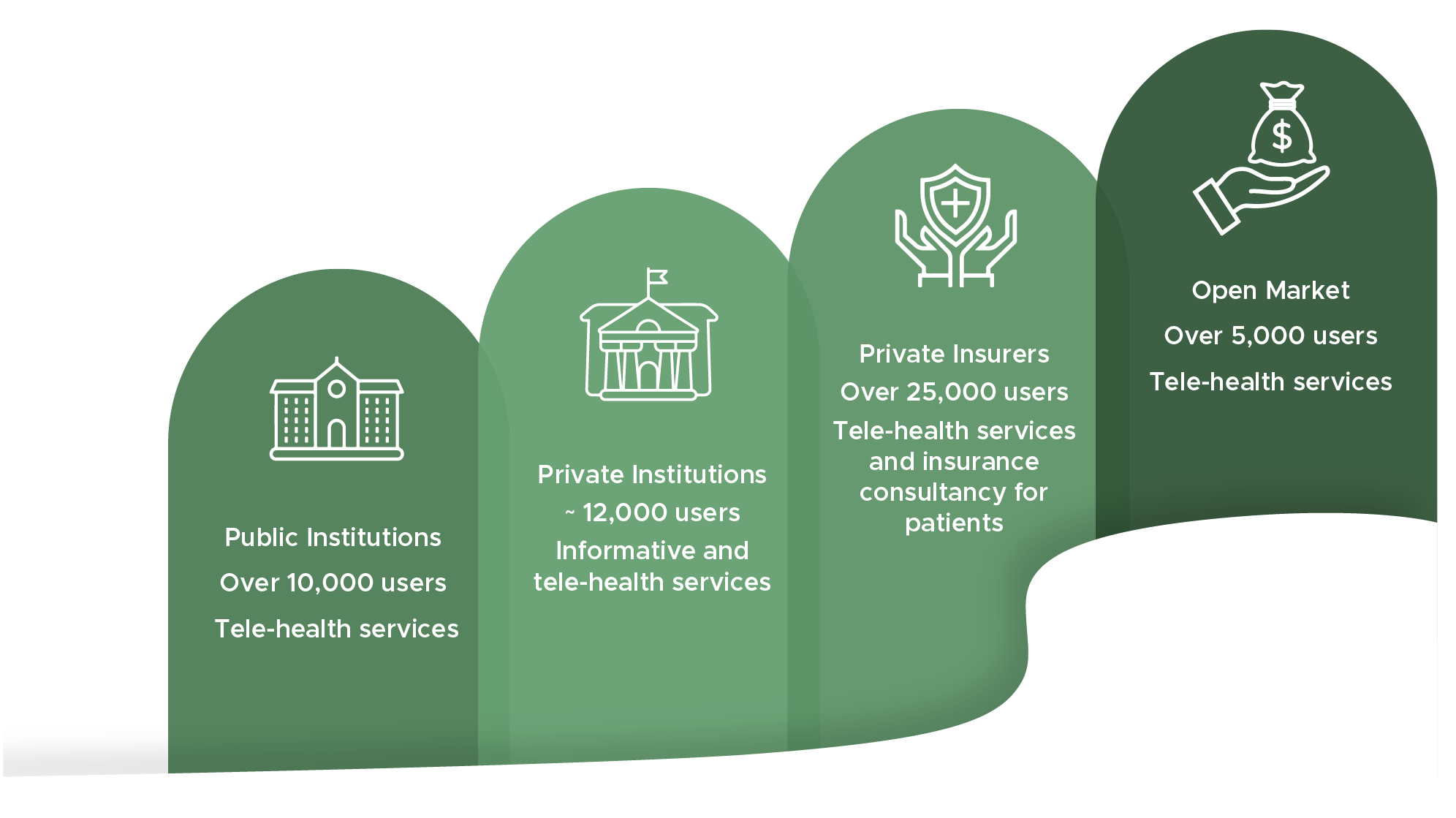

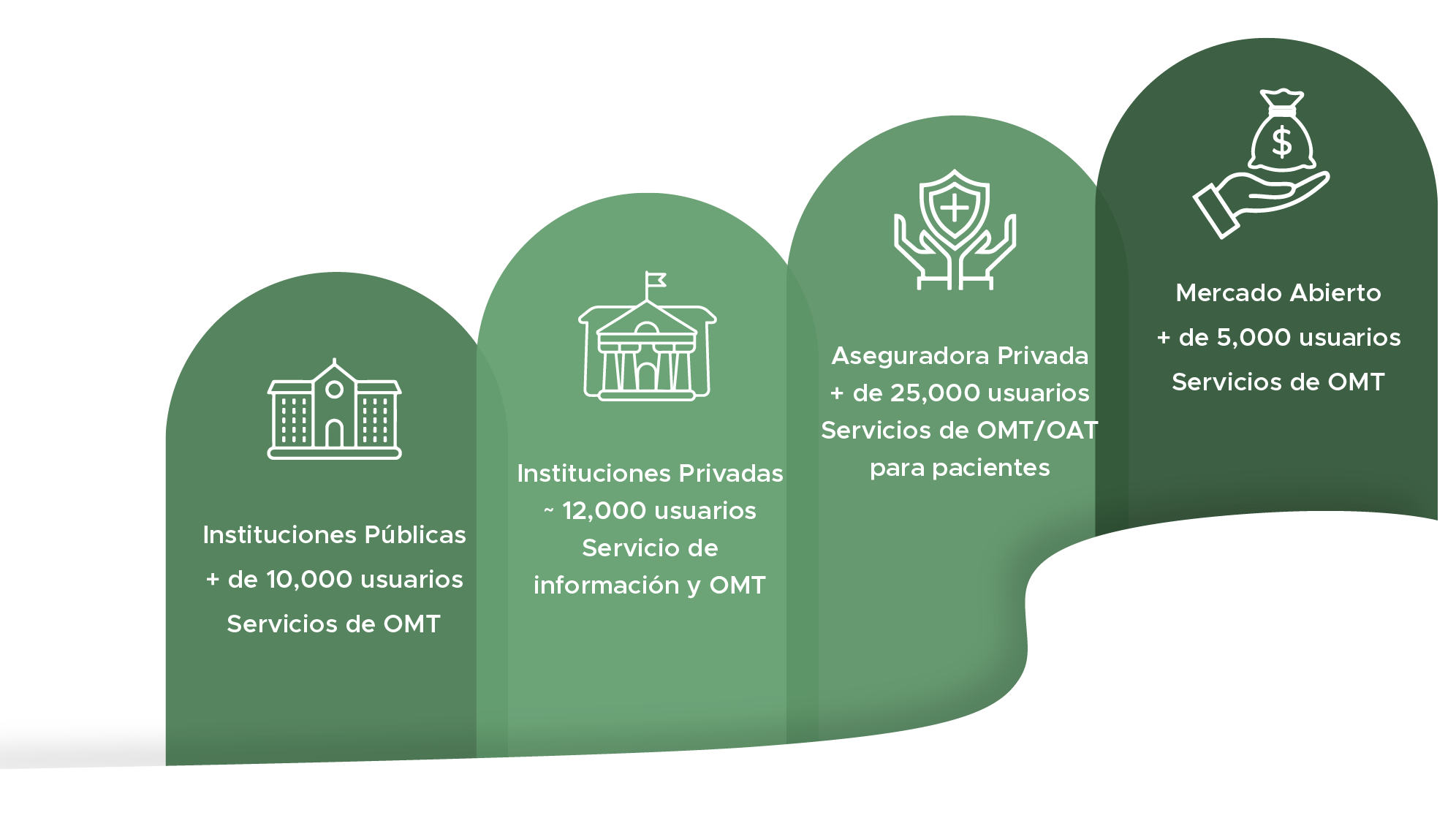

Health Services Contact Center (CCSS)

In order to achieve greater efficiency and reduce health costs, CCSS - Peña Verde, S.A. de C.V., a company specialized in tele-health services, links its more than 52,000 users (from public and private institutions) to the appropriate level of medical care.

REINSURANCE

Reaseguradora Patria

The oldest reinsurance company in Latin America with international presence (having a strong foothold in Latin America and increasingly growing overseas operations), providing comprehensive risk management services since 1953, as well as personalized economic, technical, and administrative advice. Its main business partners are insurance companies, surety companies, and reinsurance brokers.

It is important to mention that, during 2021, Grupo Peña Verde continued to make progress in the gradual run- off of its special purpose vehicle at Lloyd’s (SPA6125), as announced at the end of 2020.

BUSINESS SUPPORT AND TRANSFORMATION DIVISION (SET)

Division that drives the Group’s transformation through the management of projects aligned to the strategy, while ensuring regulatory and legal compliance, as well as verifying risk levels falls within tolerance thresholds. The purpose of these processes is:

Technology Plan:

- Operate in a more efficient and standardized manner, reducing time and cost.

- Support future business growth with a high degree of flexibility.

- Integrate new technological solutions.

- Stabilize technological investment, according to market standards for innovation projects.

- Foster a flexible and innovative culture that encourages risk-taking focused on individual and collective results.

- Encouraging a culture of accountability.

ASSET MANAGEMENT AND FINANCIAL STRATEGY DIVISION (GAEF)

This division was created to manage the investment portfolio, corporate finance, administration and finance, and procurement. With this, the Group seeks to integrate in a single department the administration and efficient use of capital as a scarce asset, in order to achieve above-market returns thorough an optimal capital structure.